Homebuilder KB Homes reported that the average homes they sold ending in August rose 9% to an average of $327,999. In the West, prices jumped 20% to an average of $579,000. But the number of homes sold dropped by 2%.This disparity is because this agency specializes in high price ticket items, the plus one million range, that are still selling, while houses below $200,000 have stalled completely, falling over 30% last month.

These types of number games are being used to disguise the fact that the housing market right now is entering the same volatility we saw right before the 2008 crash. While the government keeps telling us the number of houses for sale is decreasing, in actuality inventory rose 2% and up 16%, according to RealtyTrac, from a year ago, using real numbers and not fictitious ones like the Commerce Department is using. Among these homes for sale, not all are even finished building yet, which if factored in, makes the jump to 23% from a year ago. Homes for sale are starting to stack up as buyers have once again left the market. First time buyers were priced out by cash investors which drove up prices to a point where they can't make a profit anymore. Less and less people are buying houses and the government is blatantly lying to us about that now which I have successfully proved.

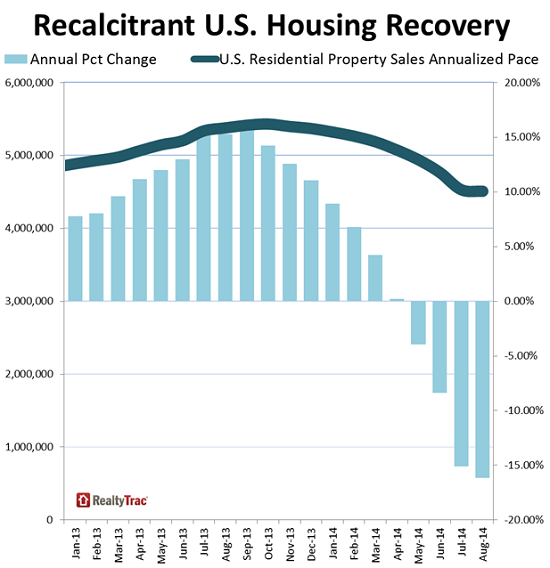

Check out this chart that shows how bad things really are:

Notice how sales start falling in March and continue to slide even worse today. Here's the rub though, even though sales are decreasing, prices are continuing to rise. Much like the Stock Market lately, even though four out of five companies are losing money on the revenue side, their stock continues upward. When this kind of thing happens, markets crash eventually. And both the Dow and the housing market look like steep slides ahead as when this happened in the past, like 2008, this race ends in a fiery crash. Much like everything else right now, the rich are getting richer as expensive homes are still selling while the rest of us starve. Homes worth less than $200,000, or 50% of the market, dropped 9% in price over the last year. How is that a recovery?

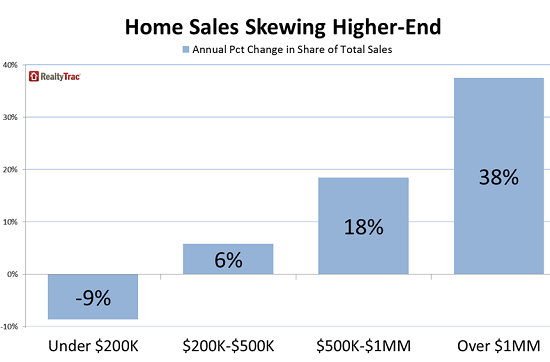

This chart below shows how the price skewers the real numbers as the housing glut is running over the middle class while the rich, which compromise a small portion of society, is doing just fine.

This is from Investment Watch:

This chart below shows how the price skewers the real numbers as the housing glut is running over the middle class while the rich, which compromise a small portion of society, is doing just fine.

This is from Investment Watch:

Fewer listings and an exodus of investors weakened

home sales in August.

weakened

home sales in August.

The number of signed contracts to buy

existing homes fell 1 percent in August compared to July and is down 2.2 percent

from August of 2013, according to the National Association of Realtors. Analysts

had been expecting these so-called pending home sales , a future

indicator of closed sales, to remain unchanged month-to-month. The Realtors’

pending home sales index is still, however, at its second highest level in the

last year.

, a future

indicator of closed sales, to remain unchanged month-to-month. The Realtors’

pending home sales index is still, however, at its second highest level in the

last year.

“Fewer distressed homes at bargain prices

and the acknowledgement we’re entering a rising interest

rate environment

likely caused hesitation among investors last month,” said Lawrence Yun, chief

economist for the Realtors. “With investors pulling

back, the market is shifting more towards traditional and first-time buyers who

rely on mortgages to purchase a home.”

environment

likely caused hesitation among investors last month,” said Lawrence Yun, chief

economist for the Realtors. “With investors pulling

back, the market is shifting more towards traditional and first-time buyers who

rely on mortgages to purchase a home.”

But because first time buyers have been either priced out of the market by cash investors or can't get a loan because banks are so tight fisted these days. Either way, the little guy gets screwed. We are rapidly heading for a fall people and voting in the Republicans to fix things is like hiring the fox to guard the hen house. It's going to end bloody.

No comments:

Post a Comment