Then there is the Colorado "election" which was nothing more than a blatant power grab to deny Trump the nomination. Resident Asshole Reince Priebus (how often was this guy beaten up in school and is now taking it out on the rest of us?) has defended the outcome saying "them's the rules," not understanding that if the game is rigged, which this process is, rules do not matter. If you are cheating legally, it is still cheating. Just because people have offshore money doesn't make them crooks, some say. That is true, but the rest of us don't have to like how the game is played when 99% of us get fucked up the ass at the end of each turn. What idiot wants to play that game, regardless of the rules?

The rich are stealing from us blind. And because it is so complex and boring, no one is willing to pay attention. If they did, politicians would be lined up in the street and shot. But because there are no cliff notes for it, no one knows and no one cares. Right now the DOW is reaching record highs, around 180 points up as of 3 PM. Why? The IMF, Bank of America and Goldman Sachs all had terrible predictions for the rest of the year for the global economy, retail sales have disappeared resulting in lots of store closing and hundreds of thousands of jobs that will disappear over the next few months, and plummeting oil, which investors said "meh" to. What do they know that the rest of the world doesn't because everyone and everything seems to be winding down not up?

Here is a list of all the problems occurring right now as the DOW appears to be moving and further and further away from reality, ala 2007 from activistpost.com:

- The Federal Reserve Board of Governors just held an “expedited special meeting” on Monday in closed-door session.

- The White House made an immediate announcement that the president was going to meet with Fed Chair Janet Yellen right after Monday’s special meeting and that Vice President Biden would be joining them.

- The Federal Reserve very shortly posted an announcement of another expedited closed-door meeting for Tuesday for the specific purpose of “bank supervision.”

- A G-20 meeting of finance ministers and central-bank heads starts in Washington, DC, on Tuesday, too, and continues through Wednesday.

- Then on Thursday the World Bank and the International Monetary Fund meet in Washington.

- The Federal Reserve Bank of Atlanta just revised US GDP growth for the first quarter to the precipice of recession at 0.1%.

- US banks are widely expected this week to report their worst quarter financially since the start of the Great Recession.

- The European Union’s new “bail-in” procedures for failing banks were employed for the first time with Austrian bank Heta Asset Resolution AG.

- Italy’s minister of finance called an emergency meeting of Italian bankers to engage “last resort” measures for dealing with 360-billion euros of bad loans in banks that have only 50 billion in capital.

Analysts say it has been the worst start to the year since the financial crisis in 2007-2008 and expect poor first-quarter results when reporting begins this week…. Analysts forecast a 20 percent decline on average in earnings from the six biggest U.S. banks, according to Thomson Reuters I/B/E/S data. Some banks, including Goldman Sachs Group Inc (GS.N), are expected to report the worst results in over ten years.(Reuters)

This spells trouble for the financial sector more broadly, since banks typically generate at least a third of their annual revenue during the first three months of the year…. Bank executives have already warned investors to expect major declines…. Citigroup Inc (C.N) CFO John Gerspach said to expect trading revenue more broadly to drop 15 percent versus the first quarter of last year. JPMorgan Chase & Co’s (JPM.N) Daniel Pinto said to expect a 25 percent decline in investment banking. Several bank executives have warned about declining quality of energy sector loans.

“The first quarter is going to be ugly and we don’t think that necessarily gets recovered in the back half of the year,” said Jerry Braakman, chief investment officer of First American Trust, which owns shares of Citigroup, JPMorgan, Wells Fargo and Goldman. “There are a lot of challenges ahead.”

BofA’s Michael Contopoulos warned last week, it may be the worst default cycle in history with “cumulative losses over the length of the entire cycle could be worse than we’ve ever seen before.”

Over the weekend, the FT got the memo with a report that … said that “the global bond default rate by companies is running at its highest since 2009 with the US accounting for the vast majority, according to rating agency Standard & Poor’s. A further four defaults this week, with three coming from the troubled oil and gas sector, pushed the overall tally to 40 with a little over a quarter of 2016 done.” (Zero Hedge)

How were so many so wrong? Expect those numbers that JP Morgan gave out are as rigged as the election. There is no way these guys could pull in such a spectacular profit margin without stock buybacks and other accounting tricks to hide how bad they might actually be.

Austria banks are struggling. Deutsche bank is barely hanging on but get a thumbs up this week for being the latest business to pull out of NC and their anti-gay stance. Italy is on it's last legs as their economy appears to be seconds from going belly up and with it possibly the EU and the global economy.

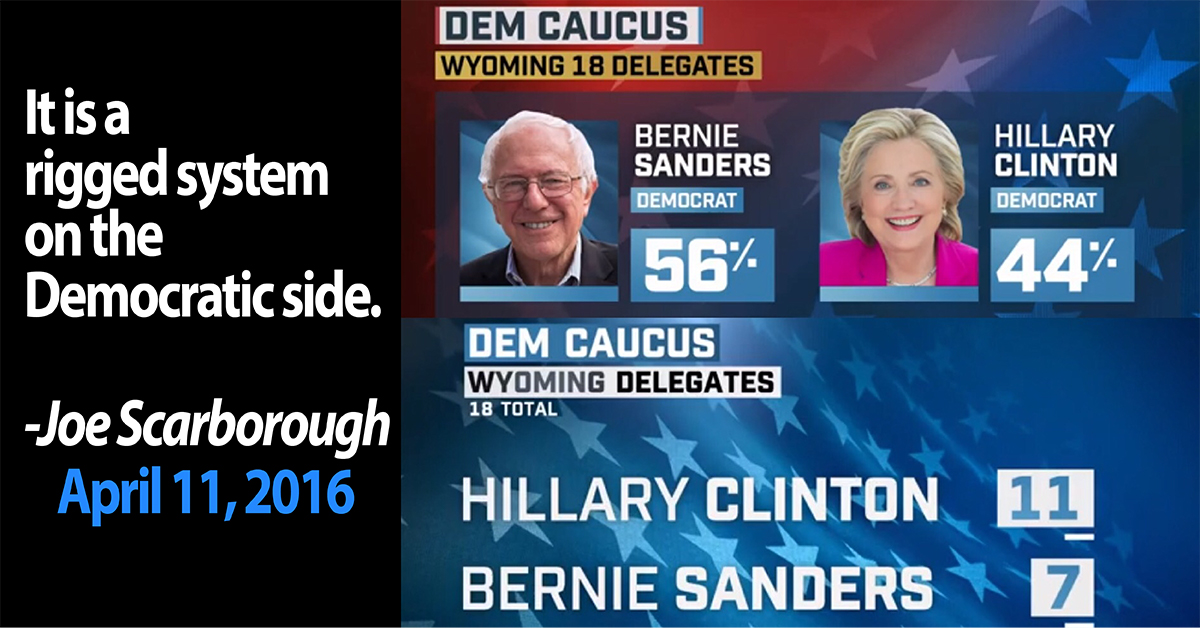

All of this is why banks and politicians worldwide are holding emergency meetings as the global economic system might go poof at any moment. Yet the stock market is going up. And our elections are fair. I also have a nice bridge to sell you. The end could come at any time people because when the next crash occurs, there will be little anyone can do to stop the inevitable. A depression looms. Make sure you think of that when you vote in upcoming primaries, like NY. Vote Bernie and we may see light. Anyone else and get your will ready because this country is on borrowed time.

No comments:

Post a Comment